In the United States alone, there are over 10 million people employed as independent contractors.

If you’re thinking of hiring one, you need to know how to make a pay stub. This ensures full transparency on the part of the contractor and the employer so there aren’t any problems when it’s efile tax time.

As you’ll see, it’s easier to do than you may think, especially if you use online tools designed specifically for this job. Keep reading to learn more about how you can make your own paycheck stubs.

What to Include in a Pay Stub

Before we jump into the process of making a pay stub, let’s go over what needs to be included in one. Having this information on hand will allow the process to go much more quickly and smoothly.

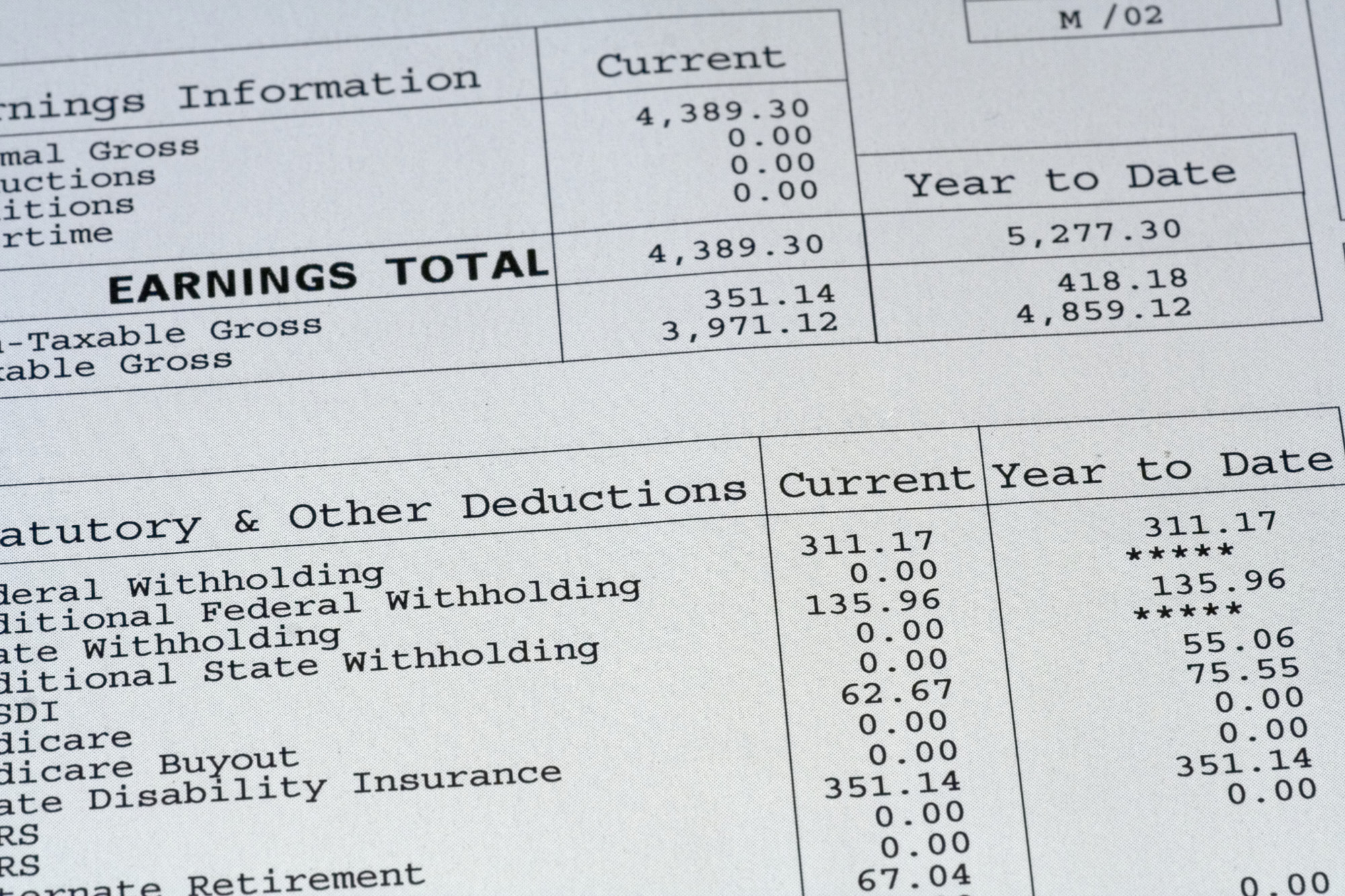

Gross Pay

The first thing you’ll need to figure out is how much is coming out of your pocket to pay a contractor. This is considered their gross pay and is the starting number for creating a pay stub.

In some cases, this may be the only number you need. However, if you need to deduct taxes and other fees, you’ll need to keep gathering information.

Deductions

The next step is to figure out what needs to be deducted from the gross pay. This could include:

- Federal taxes

- State taxes

- Local taxes

- FICA tax withholdings

- Retirement pensions

- 401k retirement plans

- Wage garnishments

If you’re deducting both taxes and retirement funds, make sure you check the requirements for retirement funds. Many of them should be deducted before taxes, so you’ll want to pay attention to that.

However, if the person you’re paying is a true independent contractor who owns their own business, they will be responsible for paying taxes and their own retirement accounts so you won’t have to worry about those.

Net Pay

Once deductions have been made, you can figure out how much is going into the pocket of the contractor. This is their net pay. It’s also the amount that you’ll be writing on the check or paying out in cash.

How to Make a Pay Stub

Now, let’s jump into how to actually make the pay stub. Once you have all of the numbers handy, it’s a fast and straightforward process.

You could simply write out this information on a piece of paper or a special pad designed for creating pay stubs. However, we recommend keeping things simple by using an online pay stub creator.

A pay stub creator allows you to fill in your information and will automatically calculate taxes based on where you live. It will also provide the net pay amount so you don’t have to figure it all out yourself.

Need More Help with Your Business?

Now you know how to make a pay stub when hiring an independent contractor for your business. By using an online tool, you can quickly and easily include all the necessary information.

If you’re looking for other ways to get your business to grow and thrive, check out our blog. We have tons of information to help you keep your company moving forward.